Cafés are booming – A key entry channel for premium ingredients

According to the Top 35 foodservice chains in Japan 2025 report, café chains led the market in year-over-year growth, exceeding +20% in 2024. They were followed by gyudon (beef bowl) chains and family restaurants – all of which saw significant rebounds driven by the return of in-person dining and a softening of remote work trends.

Collectively, the top 35 chains accounted for 33.6% of the total foodservice market by revenue, with an average growth rate of +8.5%, outpacing the industry as a whole.

Notably, cafés ranked not only in revenue growth but also topped the Net Promoter Score (NPS) ranking, suggesting strong brand loyalty and consumer satisfaction. This makes them a promising segment for European brands offering high-quality, innovative ingredients – especially those that align with Japan’s growing appetite for premium, Instagrammable food and beverage offerings.

The rise (and aging) of the RTE shopper

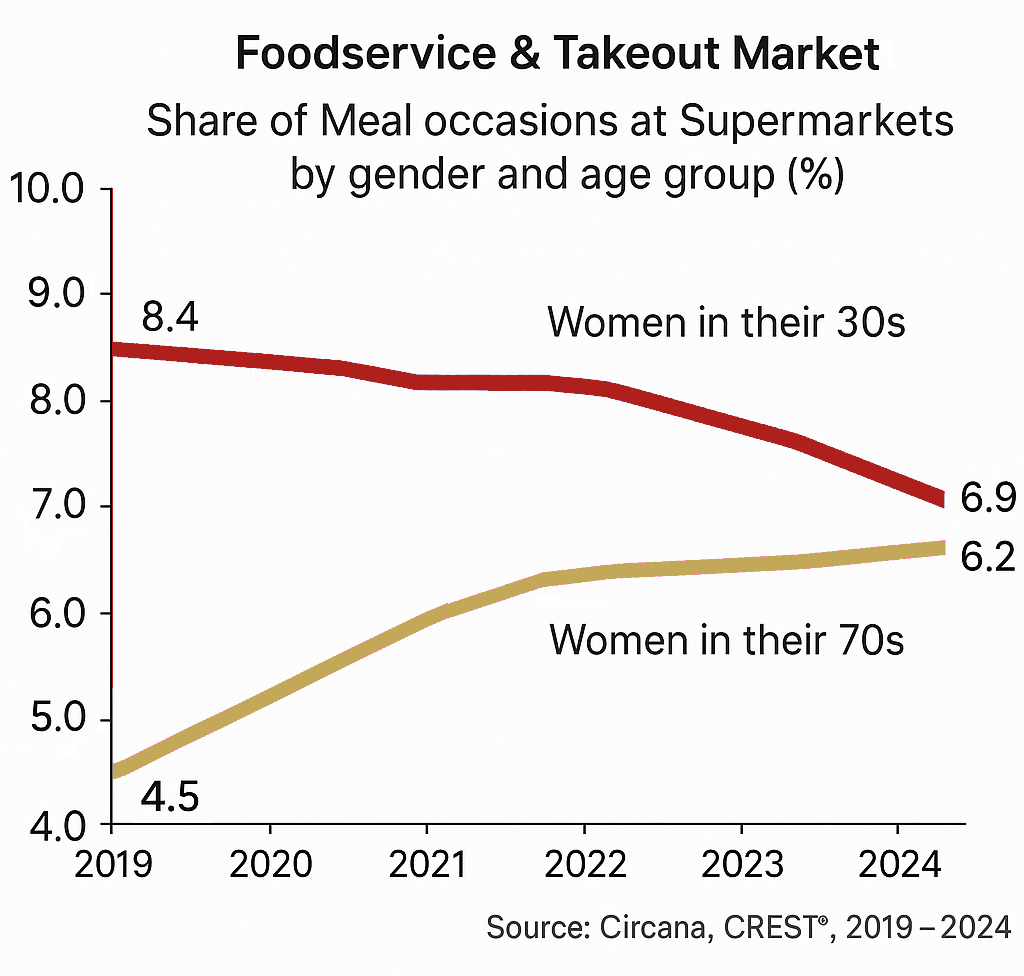

While foodservice grew steadily in 2024, the ready-to-eat segment in supermarkets faced a more challenging year. Due to inflation and price increases, consumers – especially younger families – pulled back on convenience purchases. According to Sakana Japan’s new 6-year trend report on RTE consumption by channel, the share of women in their 30s shopping for supermarket RTE meals dropped from 8.4% in 2019 to 6.9% in 2024.

In contrast, women in their 70s increased their share from 4.5% to 6.2% in the same period, signaling an aging consumer base for this channel. Older demographics tend to prioritize quality, simplicity, and nostalgia – creating space for traditional or health-conscious offerings.

Full-service restaurant surge: a sweet opportunity

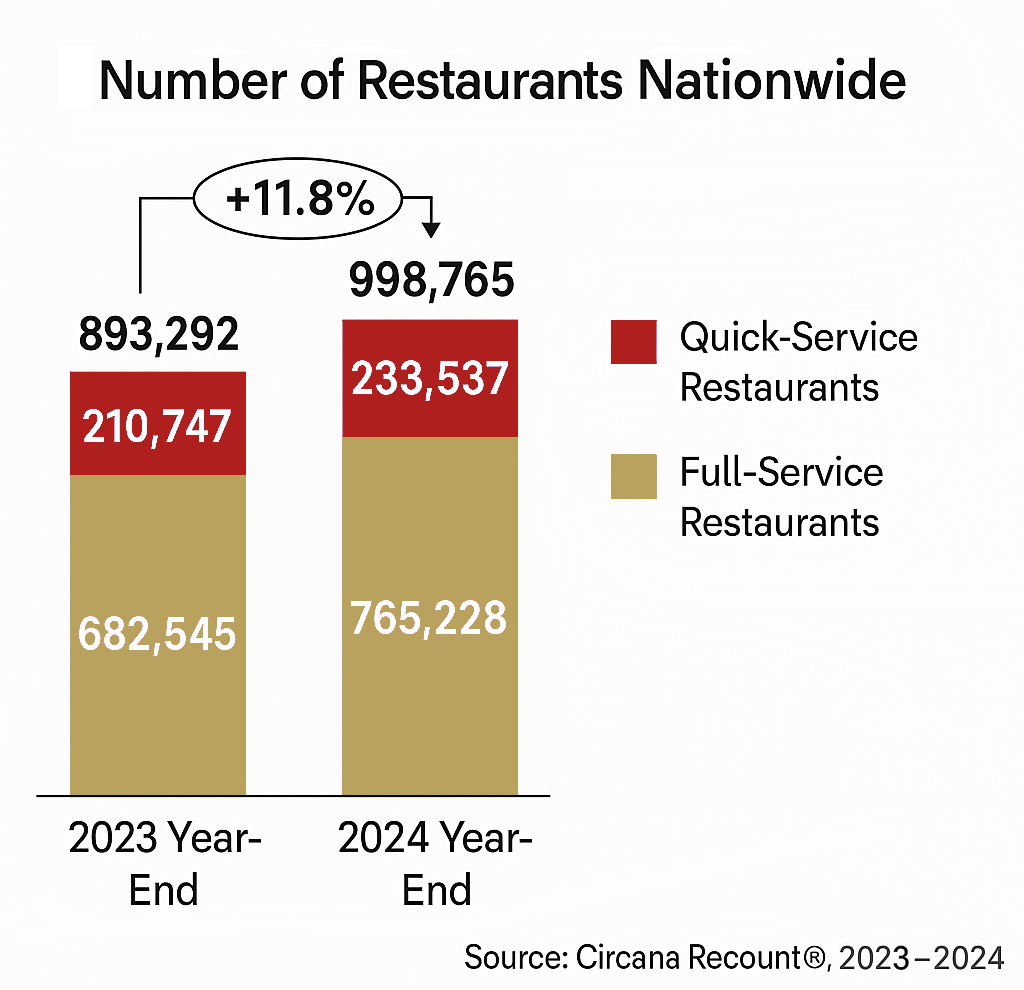

Japan’s restaurant industry continues its post-pandemic rebound, driven by a steady return of consumer traffic. By the end of 2024, the total number of restaurants in Japan had increased by 11.8% compared to the end of 2023.

Full-service restaurants have seen particularly strong growth, with a 12.1% increase. This boom is especially concentrated in major metropolitan areas like Tokyo, Osaka and Kanagawa, where dining culture tend to be more diverse and premium.

This expansion suggests significant opportunities for F&B suppliers. And for dessert manufacturers in particular, the growth of full-service restaurants is promising: guests in these establishments generally expect well-developed dessert menus, where sweet offerings are sometimes the highlight of the dining experience.

Staying ahead in Japan’s evolving food industry

Japan’s food landscape in 2025 reflects both recovery and reconfiguration. The growth of the café segment and full-service restaurants signals vibrant opportunities for innovation and European flair, while demographic shifts in the RTE sector call for more targeted strategies. At Gourmet Selection, we’re closely tracking these changes to help our partner brands adapt, grow, and thrive in this unique and demanding market. If you’re exploring opportunities in Japan or the broader APAC region, we’d be happy to connect!

Sources

サカーナ・ジャパン株式会社. (2025, April 21). 最新外食・中食レポート「前年比成長率トップは、カフェチェーン、「日本の飲食店トップ35 2025年版」発刊」を公表. ドリームニュース. https://www.dreamnews.jp/press/0000318722/

サカーナ・ジャパン株式会社. (2025, May 21). 6年分の主要データがわかる「業態選択型主要指標レポート」好評発売中、スーパーで女性30代比率が減少、女性70代が増加. ドリームニュース. https://www.dreamnews.jp/press/0000321033/

サカーナ・ジャパン株式会社. (2025, June 4). 最新外食・中食レポート「2024年末、飲食店舗数は998,765店舗、前年同期比11.8%増」を公表. ドリームニュース. https://www.dreamnews.jp/press/0000321981/