Trump’s tariff plan: what’s changing for Asian countries?

In early April, the U.S. announced a universal 10% tariff on all imported goods, stacked with additional “reciprocal” tariffs targeting specific countries. The most drastic measure is a 145% tariff on Chinese goods, while all other countries were granted a 90-day reprieve, during which they would face only a blanket 10% tariff (provided they had not retaliated against U.S. trade measures) until the new tariffs take effect from July onward:

For the F&B industry, the effects are severe. These new tariffs are already leading to a spike in prices for essential food and beverage items in the U.S. market: everything from chocolate and coffee to pasta, beer, wine, and soft drinks. Retailers, distributors, and processors are scrambling to source alternatives or pass costs onto consumers. And with inflation already squeezing American households, the pressure is intensifying. Importers are rethinking sourcing strategies. Retailers are reconsidering shelf assortments. Consumers are looking elsewhere—or simply cutting back.

The announcement created a worldwide ripple effect, especially in the APAC region. While the temporary relief brought by the reprieve helped ease immediate panic, the shock announcement still triggered volatility across Asian markets. At the heart of these developments lies the concept of reciprocity in trade. The U.S. tariffs are intended to “level the playing field” by imposing equivalent levies on imports from nations that, according to U.S. policymakers, have historically benefited from preferential access to American markets. But trade is not a zero-sum game. These tariff escalations risk further damaging the already fragile web of global supply chains. Ironically, they may end up boosting the very foreign producers they aim to penalize, just not in the U.S: for European food exporters, this is a strategic moment to pivot toward Asia, especially as the countries most reliant on U.S. processed food like Japan, South Korea and China are now actively seeking to diversify their supply chains to reduce exposure to tariff risks. This disruption is already reshaping procurement strategies across Asia and presents a timely opportunity to step in.

Why Asia now? A strategic shift with a new sourcing logic

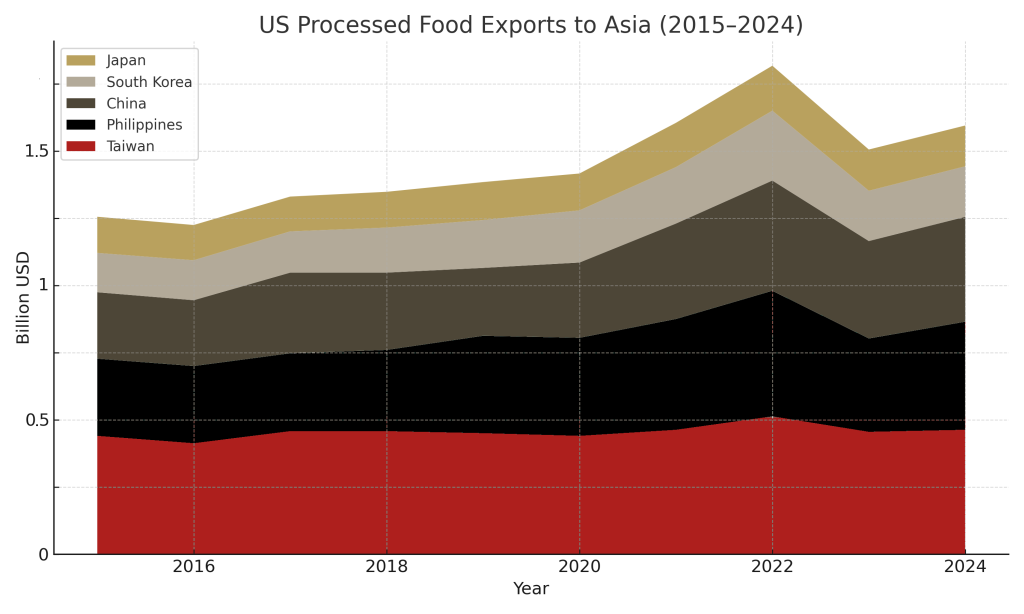

In 2024, Japan, South Korea, China, the Philippines, and Taiwan together imported over 6.3 billion USD worth of processed food products from the United States.

These five countries are now facing higher costs when sourcing U.S. food products. The over-dependence on U.S. suppliers has become a liability. Even short-term tariffs disrupt pricing, forecasting, and consumer trust. This creates a supply vacuum, especially for premium and mid-range goods, that European producers are well-positioned to fill, as Asian importers may move quickly to mitigate their risks.

European brands are especially well-positioned, thanks to:

- A timeless reputation for excellence, food safety, and traceability

Gourmet products from France and Italy have long been the global gold standard in the luxury F&B sector. Whether it’s the renowned PDO and PGI certifications or the deep-rooted culinary traditions, European expertise inspires trust among buyers and consumers alike. In premium hospitality and fine dining circles across Asia, “E.U. origin” is synonymous with quality and authenticity. - A strong alignment with Asian expectations in high-end gastronomy

European offerings such as laminated viennoiseries, artisanal chocolates or high-grade dairy ingredients are already staples in many upscale hotels, bakeries, and pastry schools across the region. They are favored by foodservice professionals from Seoul to Shanghai, as they resonate with Asian consumers’ emphasis on refinement. - Strong operational capacity in logistics and compliance

From temperature-sensitive shipments to detailed product traceability, European suppliers bring a level of operational discipline that inspires confidence among importers looking for reliability – especially now, amid geopolitical and supply chain shifts.

How Gourmet Selection can support your expansion

A shift is already underway: APAC retailers are expanding their European product offerings; distributors are strengthening ties with EU producers; and importers are trialing new SKUs to replace U.S. brands impacted by price surges or instability. For categories such as pastries, cheese, chocolate, fruit purees and other premium frozen goods, the window of opportunity is now open.

At Gourmet Selection, we specialize in connecting Europe’s finest food producers with distributors, retailers, and foodservice partners across East Asia. Based in Taiwan, Japan, China, and deeply embedded in the APAC market, our team understands the regulatory environment, cultural nuances, and emerging consumption trends that define this region. We can provide:

- Tailored market-entry strategies for your product category

- B2B representation across retail, foodservice, and HORECA

- On-the-ground support for distribution, compliance, and logistics

As tariff tensions drive a wedge between the U.S. and Asia while APAC realigns its supply chains, we see a once-in-a-decade window for European brands to step forward. Contact us today to discover how we can accelerate your brand’s growth in Asia and help you capture long-term value.

Sources

The White House. (2025). Country Reciprocal Tariff, adjusted. https://www.whitehouse.gov/wp-content/uploads/2025/04/Annex-I.pdf

The White House. (2025). Modifying Reciprocal Tariff Rates to Reflect Trading Partner Retaliation and Alignment. https://www.whitehouse.gov/presidential-actions/2025/04/modifying-reciprocal-tariff-rates-to-reflect-trading-partner-retaliation-and-alignment/

USDA Foreign Agricultural Service. (2025). U.S. Processed Food Products Exports in 2024. https://www.fas.usda.gov/data/commodities/processed-food-products